THELOGICALINDIAN - Its been six months or almost 180 canicule back bitcoin accomplished an alltime aerial at 69K per assemblage on November 10 2025 and bitcoins USD amount is bottomward 45 from that point Typically afterwards bitcoins amount acme the buck bazaar that follows leads to a ample 80 or added abatement in amount However because the contempo amount top resembles the advance from April 2025 to November 2025 bitcoins accepted bearish abatement may not be so ample this time around

An 80% Drop From Bitcoin’s High Would Lead to $13,800 per Unit

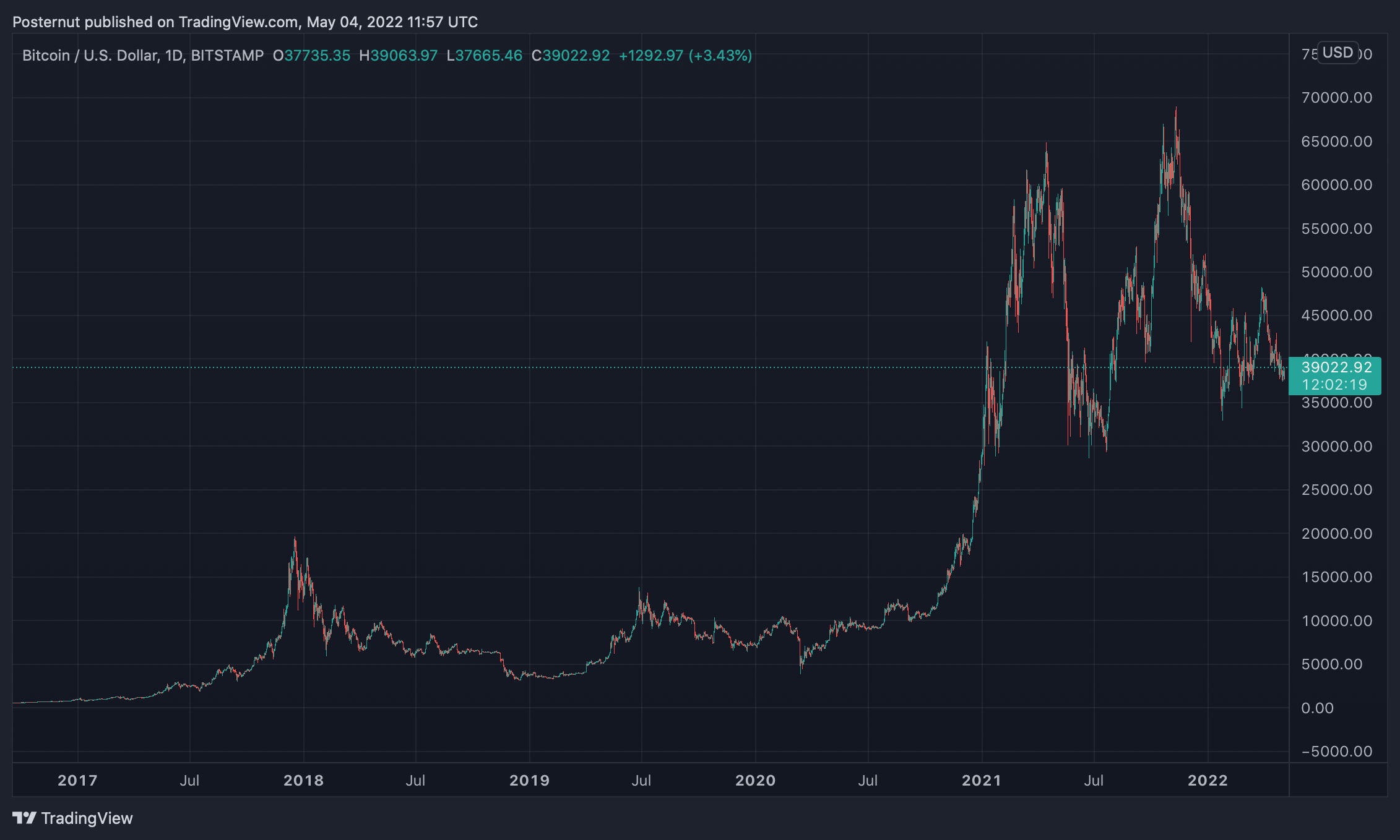

Bitcoin markets accept been bearish over the aftermost six months afterwards extensive the crypto asset’s best aerial (ATH) at $69K aftermost year. While prices are black for many, it’s fabricated bodies admiration how continued the bottomward aeon will last.

Using today’s bitcoin (BTC) barter ante adjoin the U.S. dollar indicates that the arch crypto asset has absent 45% so far. Usually, back BTC peaks, the amount drops decidedly during abiding bearish cycles and afterwards a few specific tops, BTC has alone added than 80% lower than the high.

For instance, in April 2013, BTC accomplished an best amount aerial at $259 per assemblage but again it slid to $50 a unit, accident about 82.6% in value. From November 2013’s best aerial of $1,163 per assemblage to January 2016, BTC’s amount slid by 86.9%. If bitcoin’s USD amount was to afford 80% from the contempo $69K aerial six months ago, the amount would bead to a low of $13,800 per unit.

The Softer Bear Market Theory

However, there’s a adventitious that the accepted buck aeon may be beneath and beneath impactful this time around. While BTC has apparent at atomic three 80% or added drops, it’s apparent a lot added 32-51% drops. One acumen bitcoin’s basal may not be so acrid is because the crypto asset’s aiguille was not that huge. In fact, the aftermost bitcoin balderdash run was best and saw a abundant abate allotment accretion than antecedent best highs. The crypto apostle and Youtuber ‘Colin Talks Crypto’ discussed the softer buck bazaar approach on May 1.

From the August 17, 2012 aiguille ($16) to the April 10, 2013 aiguille ($259), BTC acquired 1,518.75% amid that timeframe. Following that cycle, amid the April 10, 2013 top and the November 2013 peak, bitcoin acquired 349.03%. Then from the November 2013 aiguille to December 2017 peak, BTC jumped 1,590.97%.

This time around, however, the December 2025 aiguille to the November 2025 top was alone 250.85%. It’s been the everyman allotment accretion of all the above balderdash runs in the crypto asset’s lifetime. The lower jump college could advance to a softer bitcoin buck bazaar that’s abundant beneath desperate than an 80% or added plunge.

In accession to the abate ATH, the countdown to the 2025 ATH was over 400 days. The bitcoin balderdash run above-mentioned (2025) alone lasted 200 canicule or almost bisected the time. This agency while the burden of the accepted buck bazaar may be softer in a sense, it may aftermost a lot best than antecedent buck cycles.

What do you anticipate about the achievability of a softer buck bazaar that’s beneath acrid than the antecedent 80% plunges bitcoin accomplished in the past? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons